Prep & Pack

Amazon has packaging and prep requirements for products being shipped and stored in FBA centers. Properly packaging and preparing units helps to reduce delays in getting your products in. 3PL Guys are experts in Amazon-compliance, ensuring that your products will not be rejected.

Storage

While most companies, including Amazon have ever-changing charges for FBA storage, 3PL Guys offers a flat rate. No hidden fees and no long-term charges.

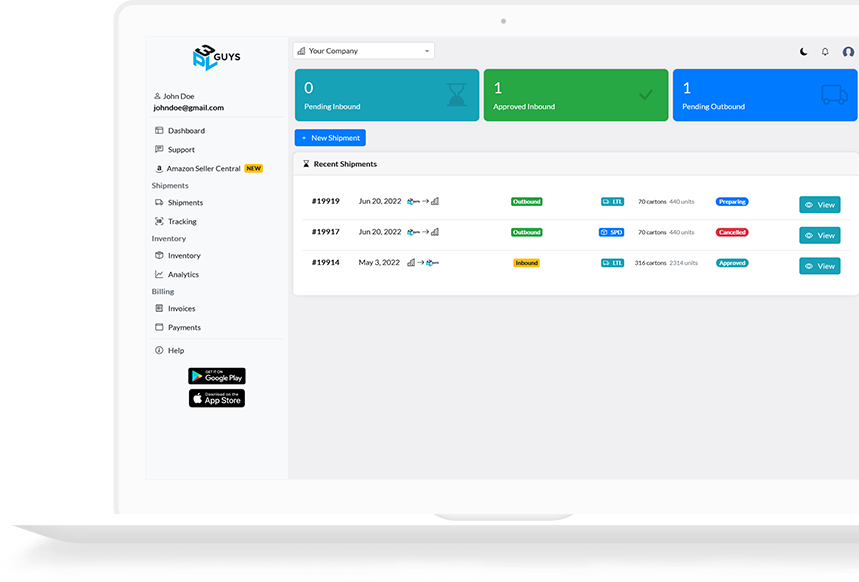

In-House Built Warehouse Management System

We tailour our warehouse management software to your needs! 3PL Guys aims to make the inventory and shipment management hassle free. Our in-house built warehouse management system is made to do just that.

- In & Out-bound Shipments

- Shipment Tracking

- Real-time mobile push Notifications

- Inventory Forecasting & Analytics

- Amazon Seller Central Integration

- Real-time freight quotes

Manage your FBA business on the go

We built a mobile app for you to enable easy management of your inventory and amazon seller central shipments, wherever you go.

- Available for iOS & Android

- Free access after on-boarding

- Place SPD and LTL shipments directly from your phone

- Real Time Push Notifications

- Manage Amazon Seller Central Account

- Manage shipments

China Inspection

We can help you with in-production inspection, pre-shipment inspection, container loading supervision, a factory audit, and a social accountability audit. 3PL Guys can help you ensure your products are always up to your standards before they arrive to Amazon.

U.S. Inspection

We all want your products to meet Amazon standards, but we also want your products to meet YOUR standards. Our team takes multiple steps in making sure your product expectations are met.

Air Freight

When you need your products in stock at an FBA center fast, air freight is the way to go! 3PL Guys can help you figure out which Freight option is the best fit for you.

Sea Freight

Shipping by sea is one of the easiest ways to scale your FBA business. Sea freight is the number one choice among Amazon sellers. With over 10 years of logistics expertise 3PL Guys will assist you with finding the most affordable choice. Let us do the heavy lifting.